It is always fascinating to contemplate what is beneath the strategy of various companies as they announce new products. Nikon’s official confirmation that it is developing some new mirrorless cameras is garnering all kinds of attention. Rather than add to all of the speculation regarding potential camera specs of these new Nikon mirrorless cameras in development, my first thought was to look at camera industry statistics. A basic question popped into my head…”Was growth in the Asian market the tipping point for Nikon with this new mirrorless camera confirmation?”

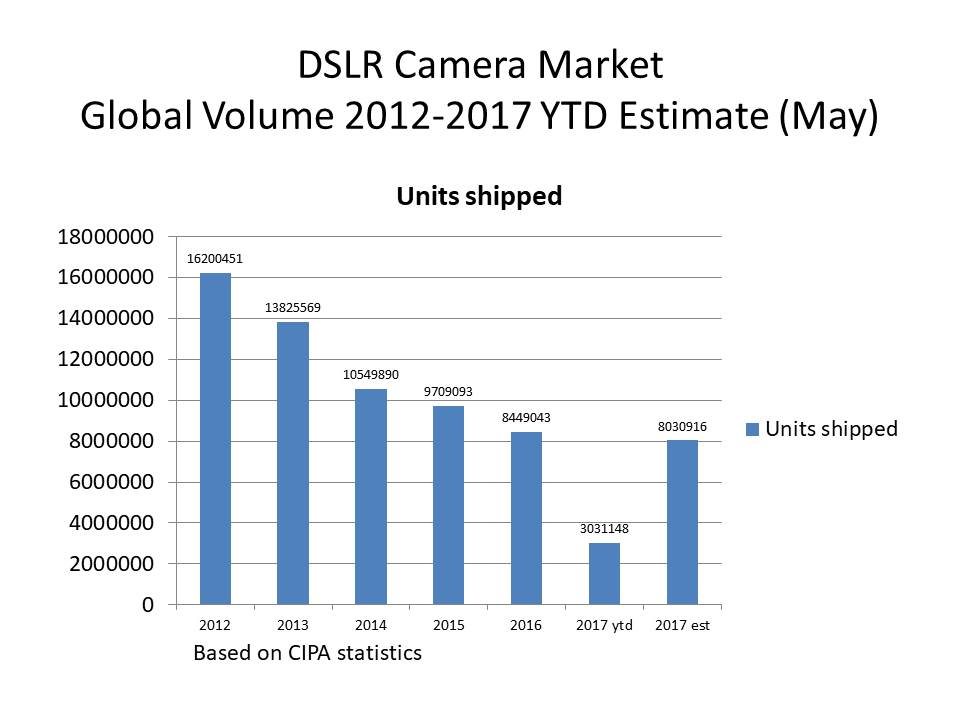

While DSLRs are still the predominate interchangeable lens camera format, demand has been eroding over time. Based on some ongoing analysis that I’ve been doing, it would appear that the shipment volume of DSLRs may decline again, albeit slightly, in 2017. At this point my best estimate is a market of approximately 8 million units for 2017.

Mirrorless cameras are showing pretty strong growth thus far in 2017, and could end up the year with a sizeable volume increase. It appears quite possible that mirrorless camera sales could surpass 5 million units in 2017. This could certainly be a factor that Nikon has been considering, especially if these planned new mirrorless cameras incorporate a full frame or APS-C sized sensor.

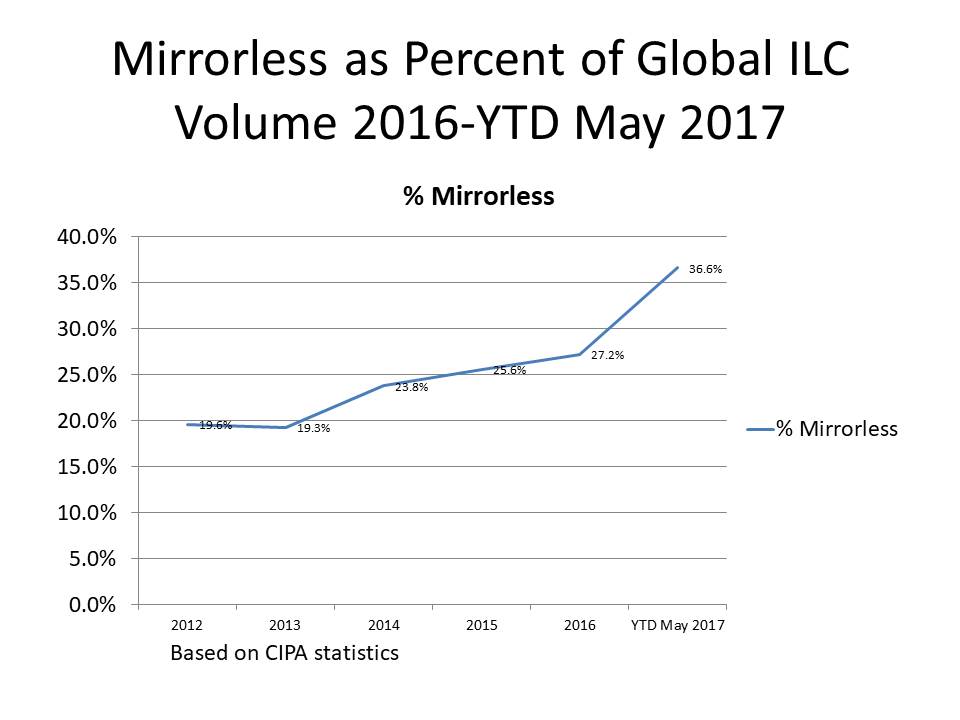

These two factors have resulted in the relative importance of the mirrorless camera market increasing significantly over the past few years, now reaching 36.6% of the interchangeable lens camera market. The sharp increase in the slope of the curve is noteworthy as it may indicate an important shift in consumer preferences.

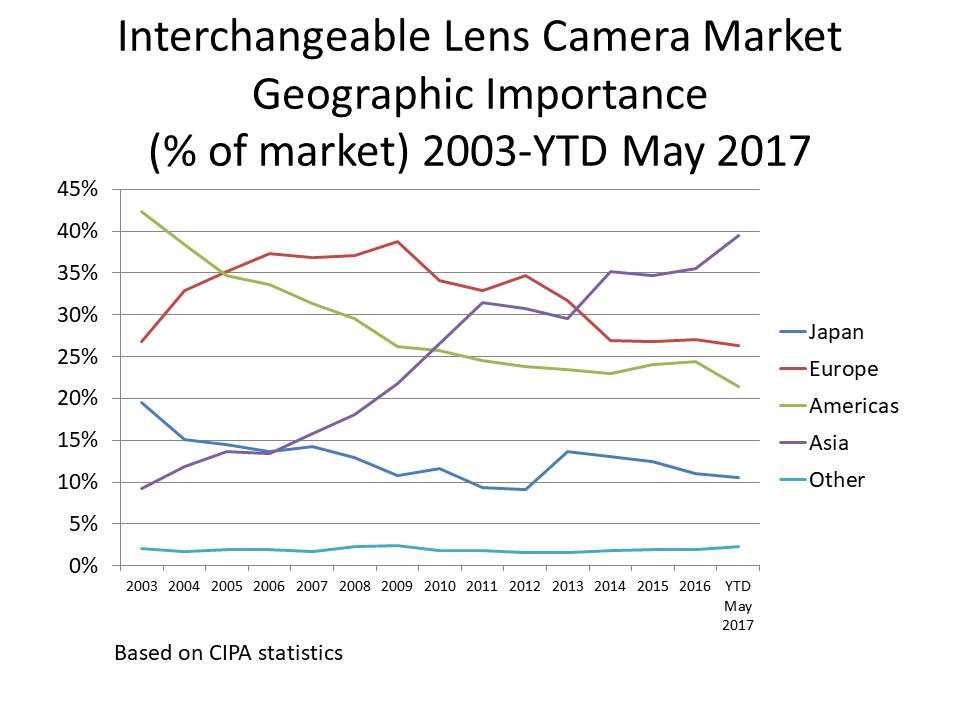

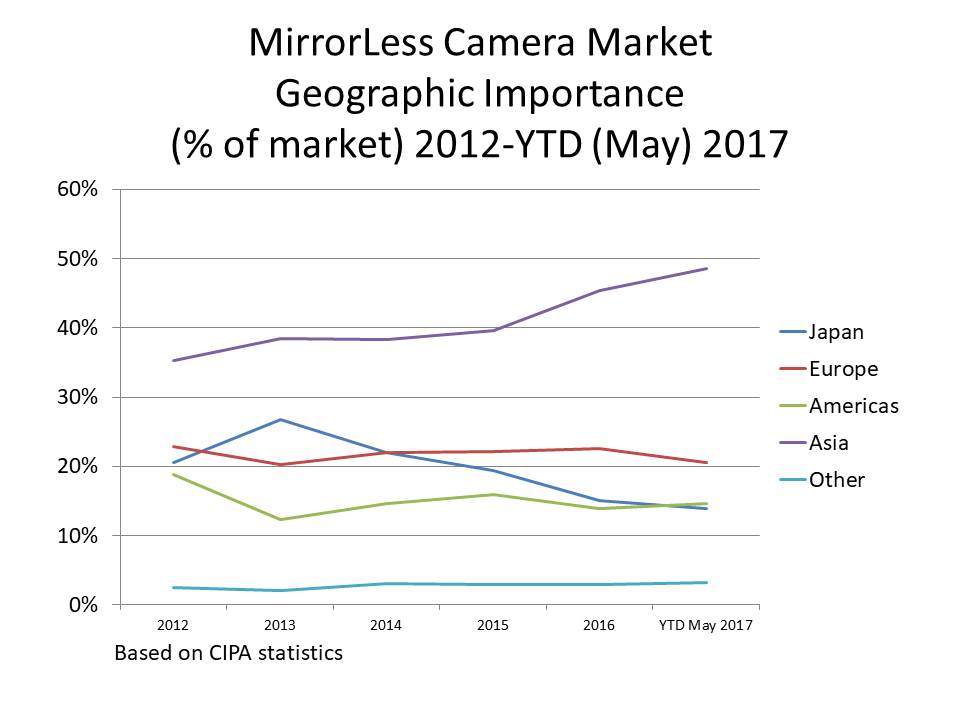

There have also been some dramatic shifts in the relative importance of various regional camera markets during recent years. It is quite possible that the dramatic increase in the importance of the interchangeable lens camera market in Asia may represent a tipping point for Nikon. As you can see in the above chart, almost 40% of the global shipments of interchangeable lens cameras are going to Asia. This compares to less than 10% back in 2003. The relative importance of the interchangeable camera market in the Americas has eroded significantly from about 43% of global shipments in 2003 down to about 22% of shipments thus far in 2017. The importance of the market in Europe has returned to where it was in 2003 – about 26-27%.

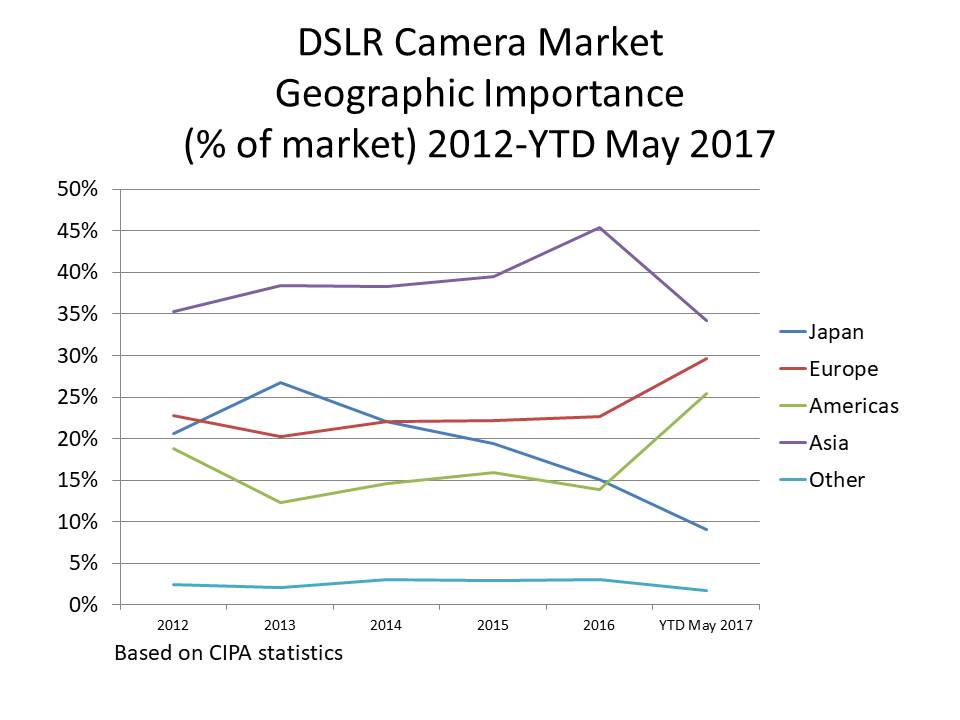

As mentioned earlier, DSLRs still represent a larger portion of the global interchangeable lens camera market than do mirrorless cameras. An important point is that the relative importance of DSLRs is declining in importance in the Asian market as well as in Japan. The market in Asia now represents less than 35% of global shipments, down more than 10% in only two years.

As mentioned earlier, DSLRs still represent a larger portion of the global interchangeable lens camera market than do mirrorless cameras. An important point is that the relative importance of DSLRs is declining in importance in the Asian market as well as in Japan. The market in Asia now represents less than 35% of global shipments, down more than 10% in only two years.

Thus far in 2017 about 45% of interchangeable lens cameras in Asia and Japan have been mirrorless. This compares to 28.6% in Europe and 24.9% in the Americas.

Thus far in 2017, Asia represents almost 50% of the global market for mirrorless cameras. When the fastest growing and largest global market (Asia) is shifting away from DSLRs and towards mirrorless cameras, manufacturers like Nikon need to seriously consider the implications of that with their product planning. If there is a tipping point in Nikon’s potential decision to launch a larger sensor mirrorless camera…I see it as the shift in importance of the Asian interchangeable lens camera market, and consumers in Asia moving strongly towards mirrorless cameras.

Article and all graphics Copyright 2017 Thomas Stirr. All rights reserved. No use, adaptation or reproduction of any kind including electronic or digital is allowed without written permission. Photography Life is the only approved user of this article. If you see it reproduced anywhere else it is an unauthorized and illegal use.

This may seem obvious but perhaps video has become a more important consideration within Asia. The use of video has grown globally and Nikon, with some of it’s latest lenses seems to have (at last?) acknowledged it, as Nasim has noted. Mirrorless does make the combination with still photography a more viable option.

Hi Omer,

I have no visibility at all on the camera preferences of buyers in Asia. Your suggestion about video could very well be a consideration. It is also possible that the emerging middle class in Asia is skewed towards ‘new technology’ and may view mirrorless cameras in that manner. I don’t know if there is any camera buying preference research on the Asian market on the internet…but I think I’ll scout around to see what I can find.

Tom

Tom,

Thanks for your article’s fine analysis and clear writing. I have to think that Sony’s A9 was a shot across Nikon’s bow. If a functional lens adapter that connect Nikon lenses to the A9 is available, then the battle is lost. Lens investment will no longer translate into camera body upgrade sales. I’m hoping that Nikon out-engineers Sony creating a bug-free mirrorless camera that accepts legacy lenses.

Hi Didaskalos,

As is often said ‘time will tell’. We’ll all know in the not too distant future where Nikon’s strategy is going.

Tom

I really hope that Nikon can and does develope a mirrorless option for for us Nikon users. I have been a SLR then a DSLR user for many, many years. I currently do not know where mirrorless or DSLR will fit into my future as right now all my lenses are Nikkor or Nikkor based and as a hobbyist I don’t want to absorb the cost of switching. If Nikon did have an option in mirrorless that would use existing F Mount then I would seriously look at how this may benefit my shooting style when I felt the need to retire my present DSLR. The weight and size saving (if there was one) would definitely come into play for me. I am 65 years old and as the years slip by anything that makes me carry and use my camera more often is an advantage. I still love my DSLR however like many Nikon users having choices is always a benefit. I would hate to see Nikon fail as I have a long history with them and really enjoy and appreciate their products.

Hi Leslie,

Like you, I’ve been a long time Nikon owner…buying my first Nikon SLR back in 1974. I have switched over to the Nikon 1 mirrorless system a couple of years ago, but I certainly appreciate that this system may not meet the needs of many other photographers.

Tom

Hi Elaine,

I agree with your viewpoint that DSLRs will not disappear from the market any time soon. People who are invested in their DSLR gear will have many more years of enjoyment from their current gear and there is no need to worry.

As the CIPA data points out, the uptake of mirrorless cameras varies considerably by region with Asia and Japan having much higher uptake rates (i.e. about 45%) than Europe (28.6%) , and especially the Americas which has the slowest uptake rate at 24.9%.. If the current trend line continues DSLRs will cease to be ‘the preferred camera’ by buyers of interchangeable lens cameras in Asia and Japan within the next year or two. This will likely not be the case in Europe or in the Americas where the penetration of mirrorless is much lower.

We differ in our assessment on the impact it would have on Nikon if the company did not introduce larger sensor mirrorless cameras. With half of the global interchangeable lens camera volume currently residing in Asia and Japan, and with those markets shifting strongly towards mirrorless, Nikon would be at risk strategically if it ignored this consumer trend in those specific markets. Looking at the growth in global importance of the market in Asia over the past 15 years it would appear likely that Asia will likely represent 50% of the global interchangeable lens camera market within a three year window. As the Asian market continues to shift toward mirrorless cameras, Nikon would be in financial jeopardy if it did not develop larger sensor mirrorless products that buyers in Asia want. In essence, this market dynamic was the focus of my article.

Tom

If we pull apart a few of these statistics, we find that from 2012 to present Nikon et al have sold 61,765,194 DSLR cameras. That is nearly 61million, 800 thousand cameras. In the same period Nikon et al sold 18,805,911 mirrorless cameras. That is rounded to 18million, 806 thousand cameras. Both are nearly neck and neck to approach their next million. It can be argued that mirrorless was and is an emerging market with improving technology throughout that same period. But that is six years for this new camera type to have caught on. In that light, it is hardly a lightning performance. If one compares the current year estimates, DSLR is projected to sell 8,030916, vs mirrorless at 5,095,533, which says that DSLR currently outsells mirrorless by about 2/3, and that with nearly 62 milliion DSLR’s already out there. What does that tell us? Well for one, mirrorless is more than a flash in the pan but not a lot more. For another, DSLR is not under threat. It is still the preferred camera by most users. What it also says is that all us DSLR users can relax because the camera makers are not going to abandon DSLR in favor of mirrorless, and though they will dedicate some of their budgets to mirrorless technology, the vast majority of budget dollars is going to go to developing and improving DSLR cameras and DSLR lenses, because that is where the income dollars are. At this point, mirrorless has not yet proven itself; it is well known that it has image quality issues by comparison with DSLR, and it looks as if that alone will outweigh its lighter weight advantages. Few people are willing to compromise over image quality. Conclusion: DSLR is a healthy technology with a bright future and Nikon lagging over mirrorless technology is not going to bring the comapany down. Our investments are safe. So we can all stop worrying and go out and happily shoot with our cumbersome, but better, DSLR cameras. :)

All this mirror VS mirrorless garbage is pretty much hyped up by the camera media, much like mainstream media that is infamous of creating hype and scandals out of non-issues. I totally agree with your logic and findings here, I actually work with numbers myself :)

On one side we have endless hype, on the other side we have a bunch of useful people pushing this “mirrored = dinosaur” narrative, basically keyboardographers. The statistics speak for itself. It’s obvious that mirrorless is gaining momentum, but the mirrored market is still strong and mature; oh let’s not forget all the mirrored bodies out there, and the countless ones circulating in the used market that produce totally brilliant results. Getting into fullframe is actually really cheap, a used D700 is $700 at most for a nice copy.

Mirrored and mirrorless are just like cars and trucks, each having its advantages and its place. There’s aspects of mirrorless that outshine mirrored, such as adaptability; there’s also aspects of mirrored bodies such as balance of long lenses. Both are really good tools to get the job done.

One major advantage of mirrorless is fast wide-angle lenses. It’s easier (according to both Zeiss and Laowa) to make fast UWA primes for mirrorless bodies, in terms of the engineering. Laowa himself proved this by making a 15mm f/2 D-Dreamer, and the sample photos I’ve seen are just gorgeous.

However when it comes to telephoto prime lenses, DSLRs have a clear advantage. Mirrorless bodies utilise 5 axis stablisation which means the sensor moves, this leads to the need to design the already large telephoto lenses with a larger image circle for acceptable image quality in the corners. DSLRs do not have this problem at all, and in-lens stablisation for telephotos are superior anyway. One has to wonder why the GM line of glass are huge, and clickbait keyboardography websites use them to push this “80mp a9 rumour” which turned out to be utterly bollocks and laughable. The glass needs to accommodate a moving sensor. UWA lenses however doesn’t have this issue.

There’s just no way to get around physics. Buy the right tool for the right application. I’d love to adapt some of my old lenses but due to Nikon’s flange, it won’t allow infinity focus. The solution? Get a mirrorless body alongside! I’m not tossing my DSLRs and I’m not buying into all this hype and clickbait. I’ll be a happy owner of both systems. It’s okay to be brand tribal, as long as one take photos and are happy with the results.