There have been some interesting shifts in the relative importance of various segments of the camera market over the past number of years. I thought readers may like to view a few charts based on CIPA data as they relate to the relative importance of various regional camera markets.

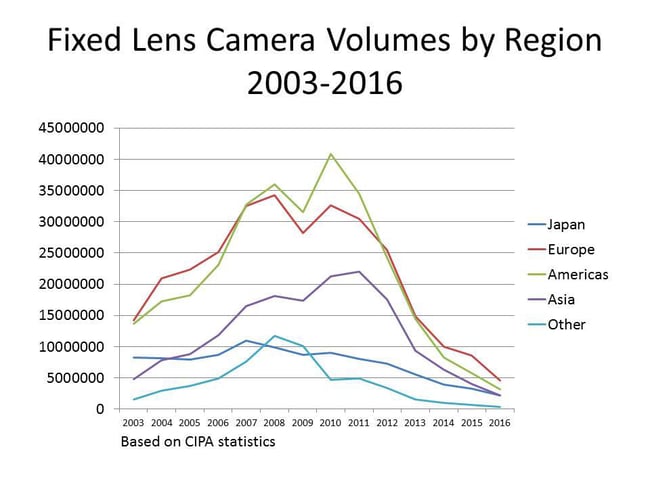

Everyone is aware of the precipitous slide of fixed lens cameras over the past number of years. The slide above shows that the shipment volume of fixed lens cameras by region as defined by CIPA. All regions have experienced significant volume erosion, with Europe currently being the largest global market for fixed lens cameras.

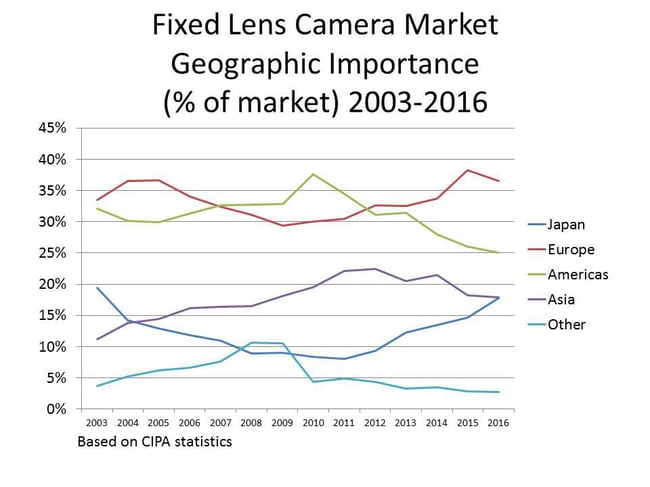

While all regions have experienced volume declines of fixed lens cameras, the slide above shows the relative importance of various regional markets. Europe accounts for over 35% of fixed lens camera shipments, followed by the Americas. Asia’s share of the fixed lens camera market has been choppy during the past 5 years with some decline in importance noticeable. The importance of the Japan market has been steadily increasing over the past 5 years and now is on par with Asia.

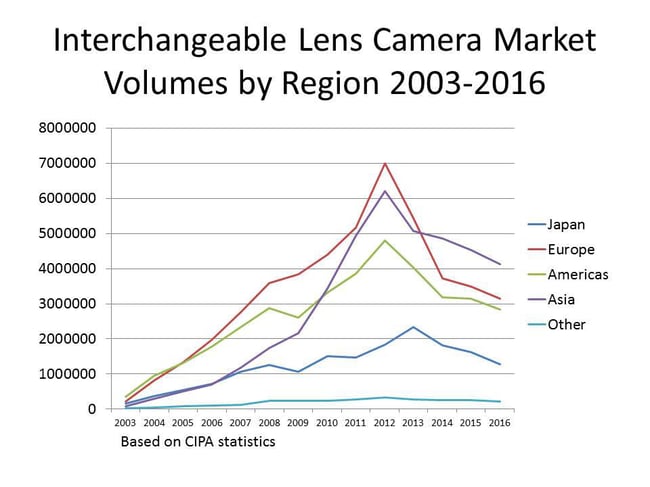

The chart above shows that all regions have experienced declines in interchangeable lens camera shipments since the market for this type of camera peaked in 2012. We can also see that the volume decline has been less severe in Asia than it has in other global regions.

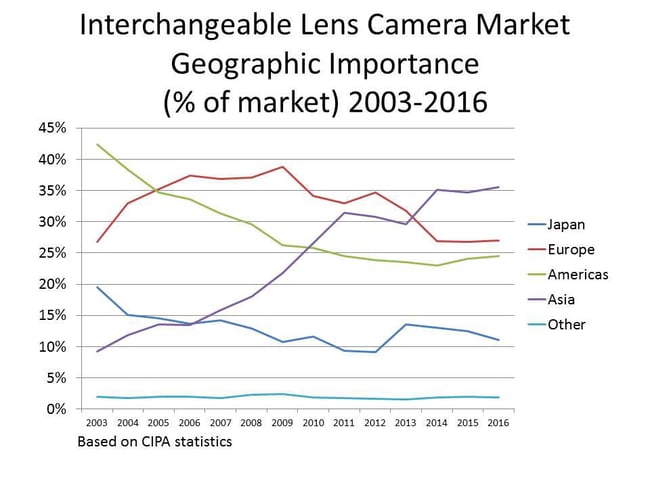

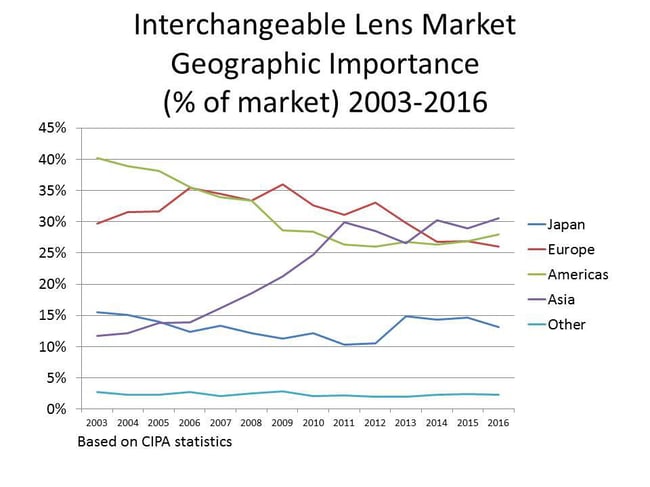

We can see some quite significant shifts in the relative importance of various regional interchangeable lens camera markets since 2003. The Americas which was the most important regional market with 42.4% of shipments in 2003 has declined to third place and now represents less than 25% of global volume. Asia on the other hand which was less than 10% of the interchangeable lens camera market in 2003 emerged as the leading market in 2014 and represents approximately 35% of the global interchangeable lens camera market.

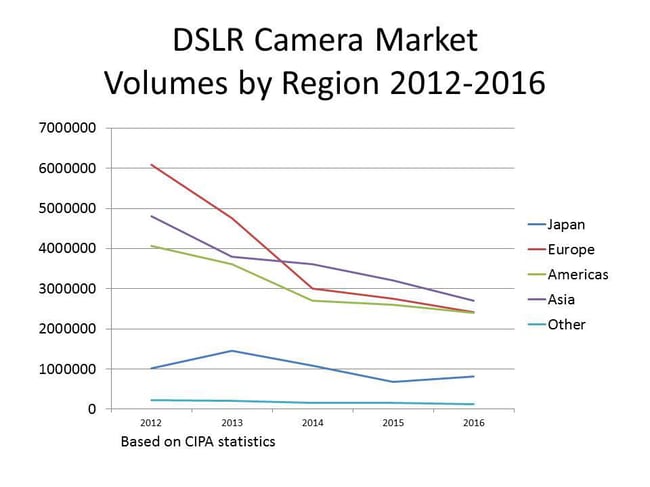

In 2012 CIPA began to report DSLRs and Mirrorless cameras separately. The chart above shows the shipment volume of DSLRs by region. We can see that in 2012 Europe was the largest DSLR market followed by Asia and the Americas. While all regions have experienced declines in DSLR shipment volume, the decline in Asia has been less severe. This has made Asia the largest volume DSLR global market.

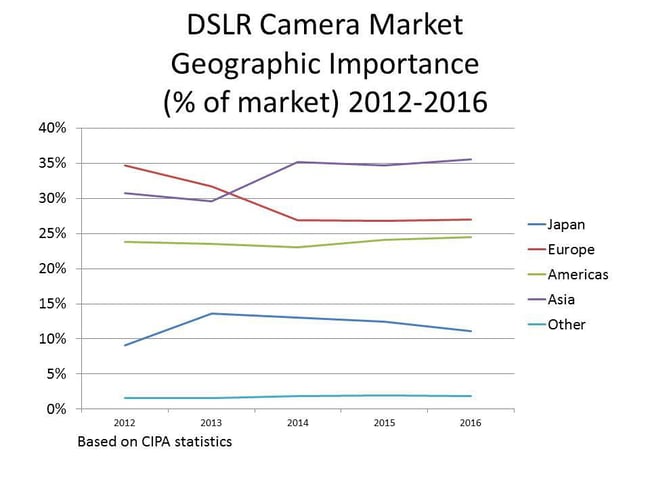

In the chart above we can see that the relative importance of the DSLR market in Asia has increased and now represents over 35% of global shipments. The decline in relative importance of Europe has stabilized, and the DSLR market in the Americas has been steady for the past five years.

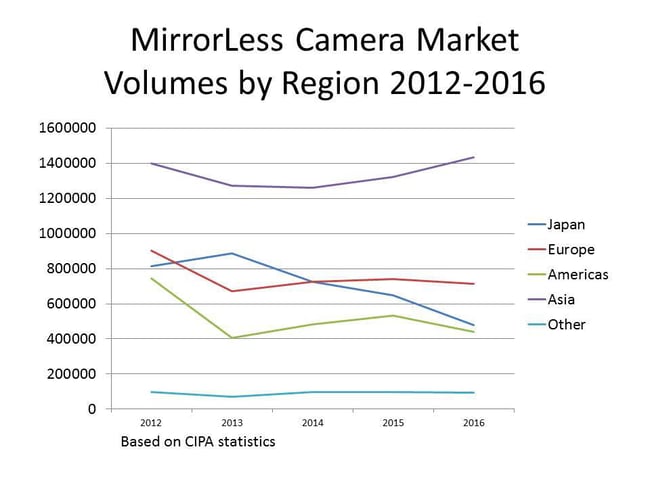

Asia has been the largest global market for mirrorless interchangeable lens cameras for the past 5 years and is the only regional market to show an increase in shipment volume for the past several years. Volumes in Japan have been softening, while Europe has been stable for the past four years. The Americas ranks fourth in volume for mirrorless camera shipments.

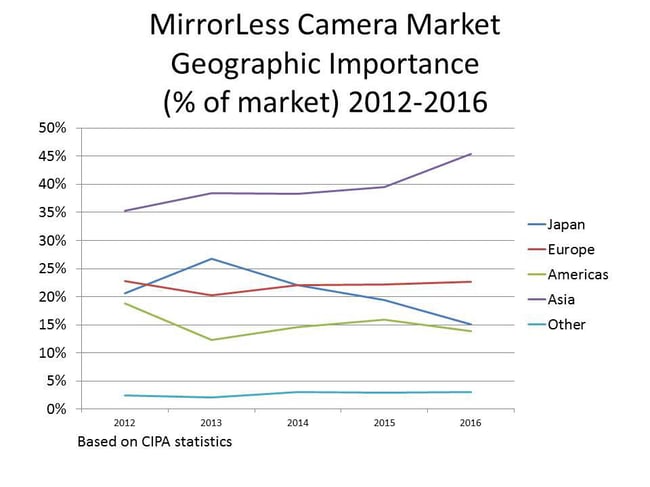

Asia is by far the most important global market for mirrorless cameras, representing over 45% of shipment volume in 2016. The importance of the Europe market has held steady while Japan has seen a steady decline in importance over the past 4 years. The Americas remains in forth spot in terms of importance with less than 15% of global shipments in 2016. This is 1/3 the relative importance of the mirrorless interchangeable camera market when compared to Asia.

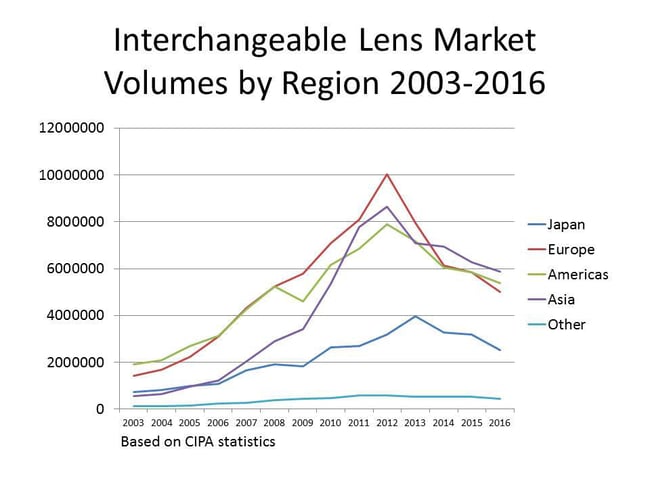

Shipments of interchangeable lenses peaked in 2012 in most global markets, while the market in Japan peaked in 2013. All regional markets have experienced declines in interchangeable lens shipment volume with Asia emerging as the largest regional market in 2014, very closely followed by the Americas and Europe.

The global market for interchangeable lenses has three regions; Asia, the Americas and Europe about 5% apart from each other in terms of importance. Asia has emerged slightly ahead of the other two regions in terms of being the most important in terms of shipment volumes.

It will be interesting to see if these shifts in shipment volume and changes in the relative importance of various regional markets, notably Asia, affect the product development of camera and lens manufacturers.

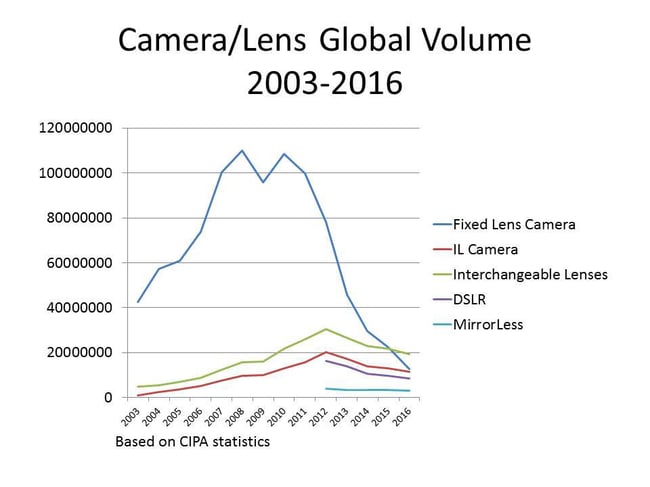

The final slide in this article shows the shipment volumes of the 5 product categories previously mentioned in this article: fixed lens cameras, interchangeable lens camera, DSLRs, mirrorless cameras, and interchangeable lenses.

In the above slide we can see that the shipment volume of interchangeable lenses is higher than any of the other 4 product categories. It will be fascinating to watch how the various camera body and lens manufacturers adjust their business strategies to deal with the realities of the various segments in the overall camera market.

Article and all graphs Copyright 2017. All rights reserved. No use, adaptation or reproduction of any kind is allowed without written consent. Photography Life is the only approved user of this article.

Hi Tom,

Somehow, I feel that your posts and Nasim’s most recent ones are somehow interconnected and linked to Nasim’s post on “Last Camera Syndrome”. The changing fates of the camera manufacturers and the systems they make are caused by a raft of reasons, perhaps as much as by changing attitudes of people towards taking/consuming/using pictures as by the changing industry landscape. Your post reminds me of the conversation I had with an industry peer days ago about the immense popularity of Fuji in the Philippines owing to their great presence here on the front and back-end of commerce and the relatively “indifferent” (for lack of a better word) after-sales and service support of Nikon here (I guess up to now, we’re still a very minor market in Asia). The good that came out of this transition to mirrorless was for a Nikon user like me to take advantage of pre-owned, still good condition, still low-actuation Nikon bodies, lenses, speedlites, being off-loaded by the Fuji converts. I myself am amazed by the low-actuations/low-usage of some of the items on the market (maybe a concrete proof of GAS?). Anyway, it would be interesting how things would pan out down the road.

Oggie

Hi Oggie,

Taking advantage of someone’s shift to another camera format or brand by buying good quality used gear can an excellent purchase! I bought one of my V2s as a used camera from a large camera store chain in Canada. It only had 112 shutter actuations on it and was literally like ‘brand new’! I paid less than half what the retail price would have been at the time.

It sounds like the quality of Nikon service varies greatly with geography. I’ve had to take gear in over the years for various Nikon warranty repairs and a few ‘regular’ repairs and the folks at Nikon Canada have been absolutely wonderful, providing top notch, fast service.

Tom

Interesting facts/stats but we need not worry as image makers will always use any available tools to create a record of our passing through this world.

Keep on snapping and enjoy the moment :-))

I agree Mar! Nothing better than exploring the world around us, camera in hand!

Tom

Thank you for adding some real data to the discussion in your two interesting posts, Thomas. Bookmarked for future reference in reply to unbased forum claims…

Hi Greg,

I’m glad you found the information helpful. I will be doing quarterly camera statistics updates on my photography blog and filed under the camera stats tab.

Tom

I use all the cameras listed above and each has particular value for me. Additionally, I am quite experienced using Photoshop and other software.

My fixed lens is in my car glove compartment for unexpected photo situations.

My Fujifilm is used when I want to travel light but still want flexibility and good photos.

When I’m very serious about a shoot out comes my Nikon D700.

Yes, I have experimented with cell phones and my iPad. Bottom line: good for quick snapshots and attaching to emails. Quality is poor compared to cameras. Just download the images into photoshop and you will see what I mean.

Future cell phones and iPads will get better, but still don,t have the sophistication of DSLRs.

Hi Peter,

Thanks for sharing your perspectives! Your comment supports the adage to ‘use the right tool for the job’.

Tom

Connecting the dots: the iPhone launched 2007 and the camera evolution steadily improved such that the iPhone 4 camera in 2010 became a real player. Not surprisingly, we can see the decline of ALL fixed lens cameras begin their decline about the same time. Like a tsunami, further evolution of the iPhone 5 camera hit the interchangeable lens and DSLR market in 2012 and accelerated with the iPhone 6 in 2014. The adage the best camera is the one you have when you need one makes the smart phone the 800# market gorilla. The perfect storm occurs along with simultaneous evolution of social media and video. Of course, professionals and enthusiasts will keep DSLR’s and/or mirrorless cameras alive but for how long and in what format?

Thanks for adding your perspectives Sandy! It will be interesting to see if any of the folks currently using cameras for their photography needs can be persuaded to enhance their photography with an interchangeable lens camera/lenses.

Tom

First, neglected to initially thank you for your data compilation and graphical portrayal; nicely done!

One other note: I’ve always wondered how the smart phone and it’s miniature molded plastic lens(sapphire protective cover) is able to resolve surprisingly good images. Not great, but still very satisfactory for many applications. The prime limiting factor being the sensor size. Given the drive towards smaller and especially lighter full larger sensor camera formats, the interchangeable lens is the weight barrier gate keeper. Glass is heavy regardless of the size of the DSLR or mirrorless format. Hence, I would be very interested in the continuing evolution of plastic camera lens for the DSLR format.

Or to mirror what will be 30 years ago this December from the ‘Graduate’: “I just want to say one word to you — just one word — ‘plastics’.”

Hi Sandy,

It will be very interesting to see what the various manufacturers do in terms of lens design and construction, especially since this market segment is the highest volume one.

Tom

I think the other factor is that the pace of improvement has slowed. I have a D7000 and was hanging on for the D7500 from what I’ve seen so far I’m not sure the overall improvement in IQ will be that huge considering the d7000 was released in 2010. So the cycle time of replacement is greater. It also seems to me that mirrorless is not making the progress expected despite the predicted death of the SLR.

Hi Paul,

My brother-in-law has the D7000 that I used to own and it is still producing excellent images!

I had a look at DxO test scores and compared the D7000 with the sensor in the D500 which apparently is going to be used in the D7500. There’s not much difference. Overall the D7000 sensor scored 80, the D500 scored 84. In terms of dynamic range the D7000 is 13.9 compared to 14.0 for the D500. A difference of 0.5EV is needed to be noticeable to most people. Colour depth was also quite close with the D7000 scoring 23.5 and the D500 scoring 24.1. A difference of 1.0 is needed to be noticeable for most people. Low light performance was also close with the D500 scoring 1324 and the D7000 coming in at 1167. A 25% difference equates to about 1/3 of a stop…so no big improvement there either.

Whether the D7500 will make sense for a D7000 owner will likely come down to the type of photography they do and specific features on the camera such as frame rate, buffer size, AF performance etc.

Tom

Thanks helpful comments I think there will be enough overall improvements to make it a worthwhile upgrade but I don’t feel a pressing need to rush out and get it on release. I haven’t looked but I suspect when the D7000 was released cameras that came out in 2005 were way behind.

I’m glad to be of help Paul!

Tom