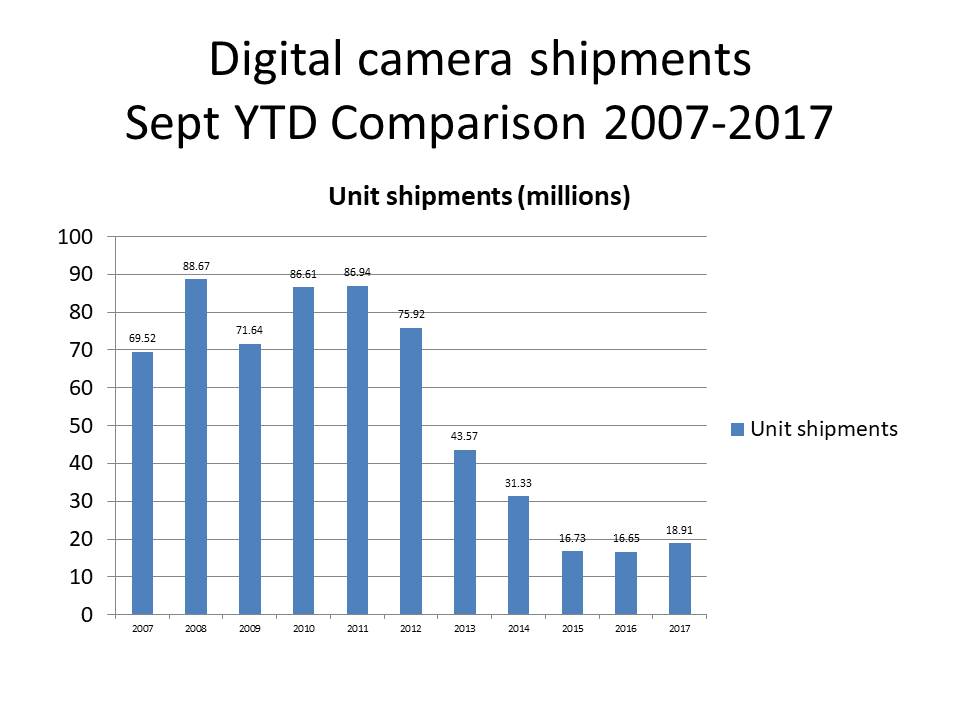

Statistical data is now available for the period up to September 2017 from CIPA. I thought readers may like to read a quick overview of how the camera market has been performing thus far in 2017. The positive news is that the camera market is tracking for some increases in 2017 in most product categories.

I took a little bit of a different approach than I usually do with this analysis and rather than compare year-end data from previous years, then estimate 2017, I have compared data on a year-to-date September basis. This will make it easier to see increases or declines in unit shipment volumes over identical time periods.

In the chart above, the first thing that is apparent is that the total camera market in 2017 is showing shipment volume growth over the past two years, based on a comparison of the first 9 months in each reporting year. Compared to the same period last year, 2017 is showing growth of about 13.6%.

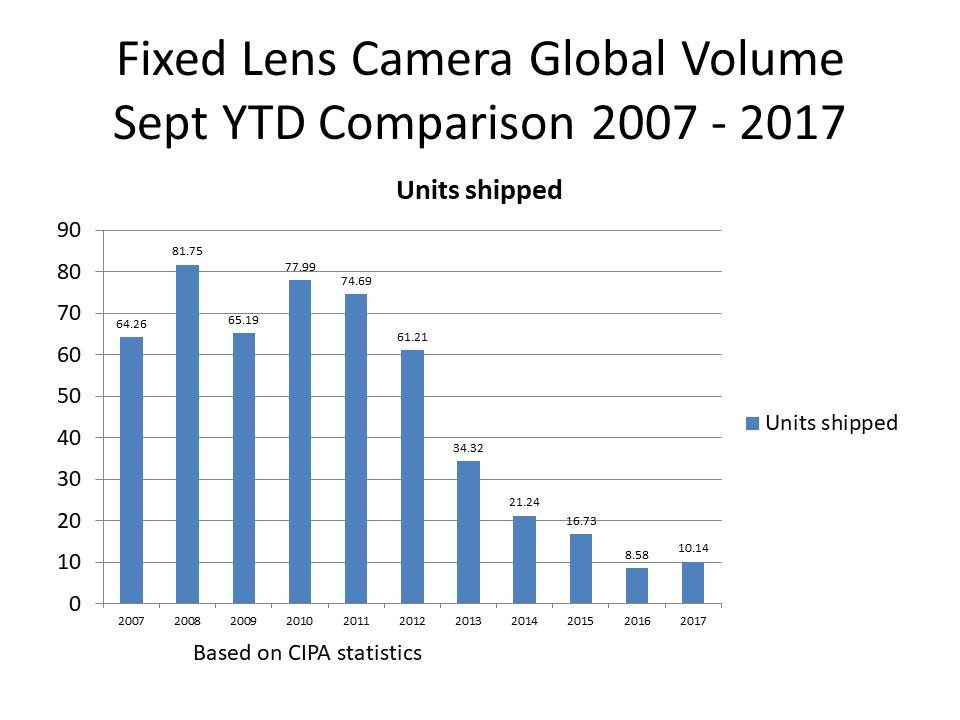

This chart shows the fixed lens camera market only. As you can see based on a comparison between the first 9 months of each reporting year 2017 is showing some decent growth of about 18.1% over 2016. You can see the impact that Smartphones have had on the fixed lens camera market over the past 5 or 6 years.

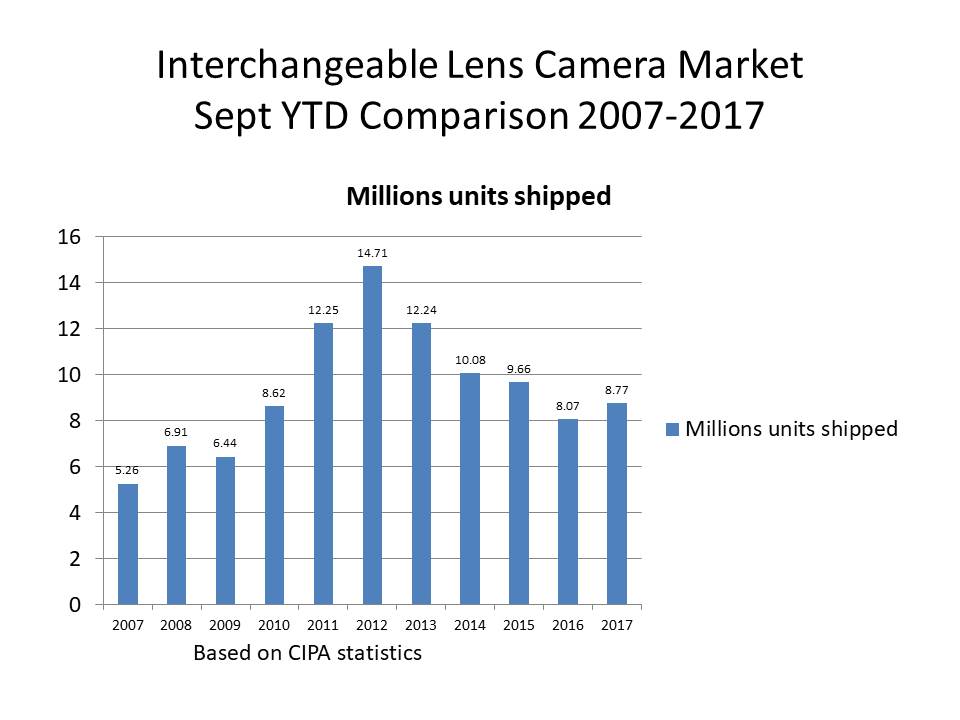

We can see that growth is also occurring in the interchangeable lens camera market with 2017 running about 8.7% higher than last year. When comparing the first 9 months of each reporting year we can see that 2017 is ahead of the 2007 through 2010 period.

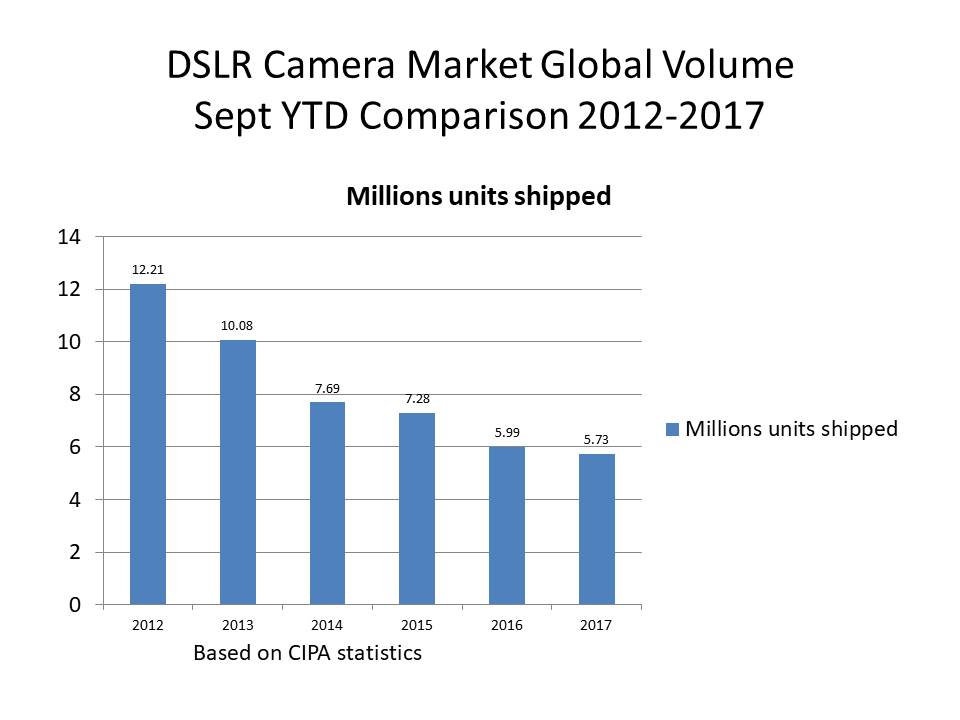

Breaking the interchangeable lens camera market down between DSLRs and mirrorless units, we can see in the chart above that DSLR shipment volume has declined slightly year-over-year when comparing the first 9 month period, about -4.3%. Whether new DSLR products like the Nikon D850 will shift this into a growth position by year end remains to be seen.

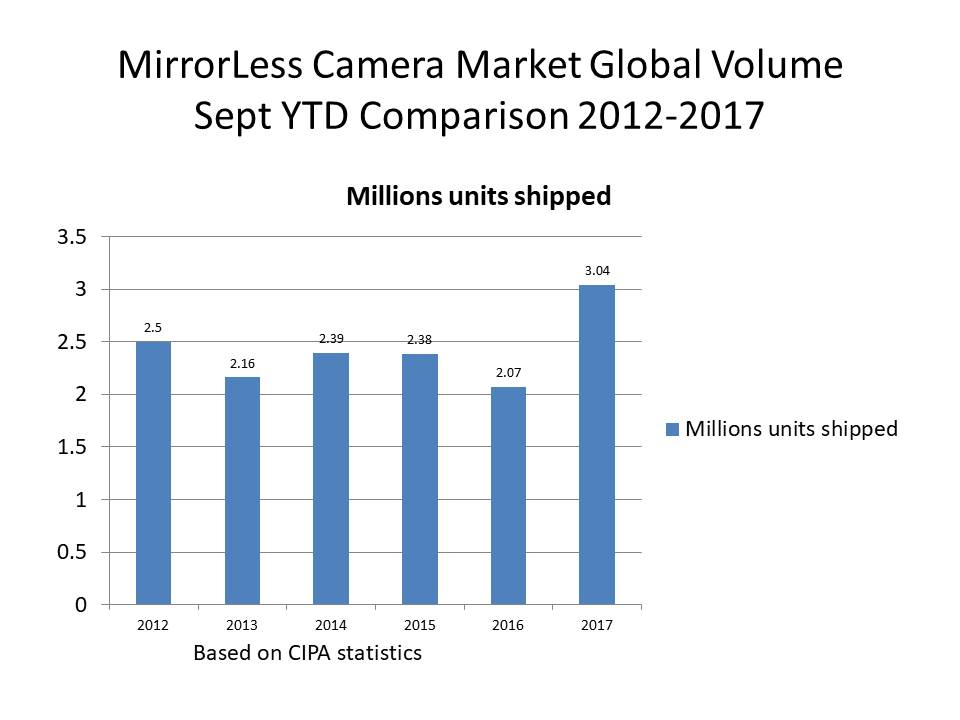

The shipments of mirrorless cameras, which has been relatively flat since 2012, have spiked in 2017. Compared to the first 9 months of 2016 mirrorless cameras are showing a growth rate of 46.9%.

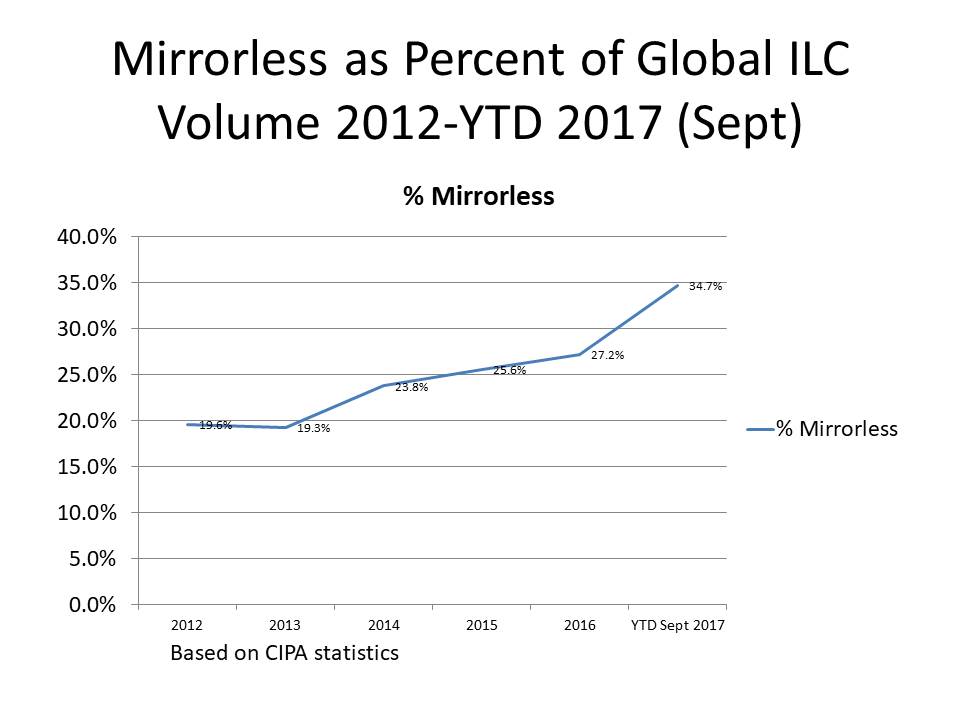

While the shipment growth of mirrorless cameras has been strong thus far in 2017, it should be noted that DSLRs are still outperforming mirrorless cameras by a ratio of just under 2:1. The chart above compares year end mirrorless market penetration with September 2017 year-to-date market penetration.

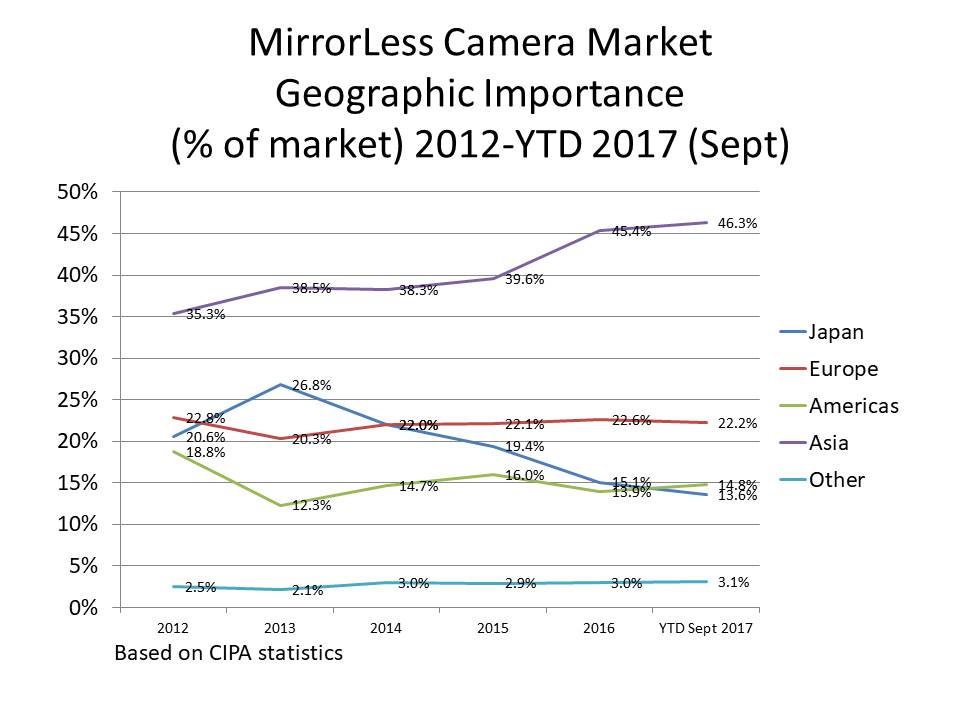

Since the shipments of mirrorless cameras has grown strongly in 2017 it is interesting to look at various regions to see how much of the mirrorless camera market those regions achieve. You can see in the chart above that Asia accounts for 46.3% of the global mirrorless camera market, followed by Europe at 22.2%, the Americas at 14.8% and Japan at 13.6%.

As a point of clarification, the percentages noted above are not the relative market penetration of mirrorless cameras of the total interchangeable lens camera market in each of the regional markets. Here are the mirrorless camera market penetration percentages of the total interchangeable lens camera market in each regional market: Japan 45.5%, Asia 42.7%, Europe 29.7% and the Americas 21.6%.

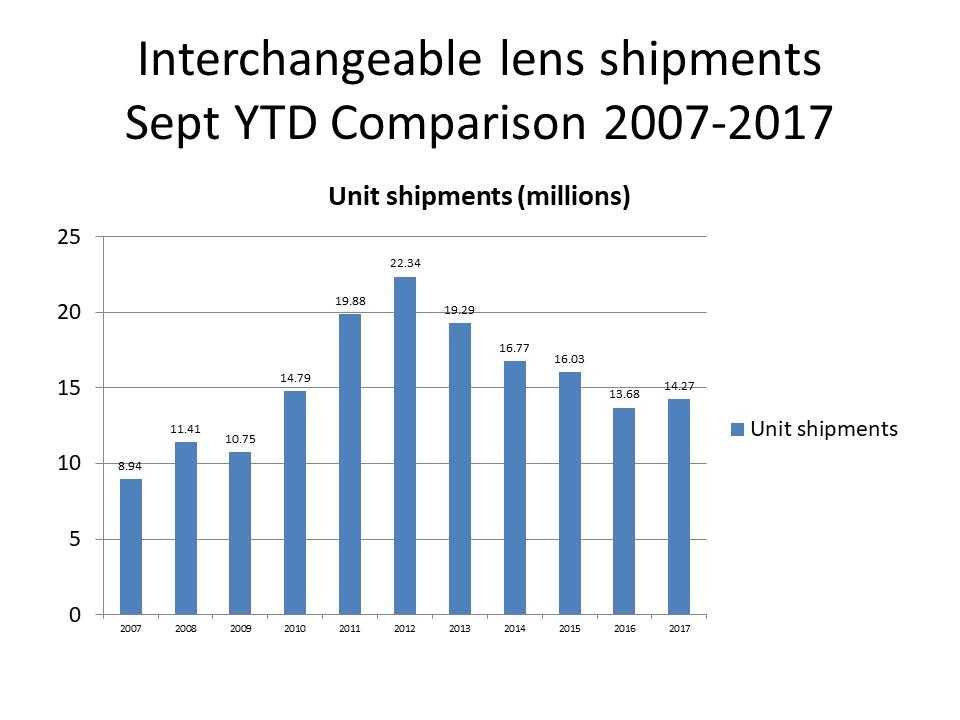

In the final graphic we can see that the shipment volume of interchangeable lenses is also up over 2016, with an increase of 4.3%.

Whether the volume increases we are seeing during the first 9 months of the year will carry on into 2018 remains to be seen. We could be witnessing some pent up demand from the 2016 Japan earthquake. Once the final 2017 data is available from CIPA, likely sometime in February 2018, I’ll update this brief article.

Article and all graphics are Copyright 2017 Thomas Stirr. All rights reserved. No use, adaptation or reproduction of any kind is allowed without written consent. If you see this article reproduced anywhere else it is an unauthorized and illegal use. Readers who call out this theft of intellectual property by posting comments on offending websites are always appreciated!

Please note: unit sales of interchangeable lens cameras (DSLR+ Mirrorless) are almost 50% higher compared to the pre-smartphone era starting in 2009. They grew strongly until 2012.

We have seen a similar development with desktop/laptop PC’s. Yes, the market has been declining in the past 6-7 years, but sales volume is still far higher than before the pad-craze started in 2010. Plus many people Asia that would have been potential customers for a PC and/or a DSLR use their smartphone for everything, often the first piece of modern tech they can afford.

So, yes, there has been a disappointingly negative development in unit sales for both product groups, but the industries have to adjust to a new reality, but that reality is actually better than it was 10 years ago.

Personally, to me nothing beats a nice big 24-27 inch desktop display and the quality of a DSLR. I will move to mirrorless when they get significantly smaller (fit in a pocket), have at least 50% of the battery life of DSLR’s and offer a similar level of all-round quality, ergonomics, lenses and other accesories.

Hi Risotto,

Thanks for sharing your perspectives and adding to the discussion! It is interesting that after starting in a positive manner for the first nine months of 2017, the camera market tailed off in the fourth quarter. The first two months in 2018 have seen some declines with comparative months last year. So, it is anyone’s guess for where the camera market will eventually end up.

Tom

I’d be interested to know if you think the mobile phone market has had that much of an impact in any decline of the interchangeable lens camera market. I know it doesn’t (or shouldn’t) have much of an affect on the enthusiast through pro segments, and maybe not serious hobbyists. But the more photography groups I’m involved with on Social Media, the more I see mobile phone users as part of the groups. To me, the comparison is ridiculous, but those cameras keep getting better and better. Do you see a correlation? And, if you do, do you see it more as a fad that will fade away in time?

Hi Jeff,

There is no doubt that Smartphones took huge volume away from the fixed lens camera market. Whether it also affected the interchangeable lens market would have depended on the needs of individual photographers. My best guess is that the impact would have been minimal with the groups that you noted in your comment. I think there’s little doubt that the cameras in Smartphones will continue to improve over time and the use of them is strongly tied to social media. I think the trend is here to stay. On the positive side there are countless more people involved with photography than there was a decade ago. This represents a huge up-sell market for camera companies if they can determine how to do this effectively.

Tom

Very interesting data well presented, Thomas! It’s good to see that even fixed-lens cameras aren’t dead-and-burried yet. And if we take phone cameras into account as well, it’s clear that photography s.l. is bigger than ever!

Thanks Greg, I’m glad you found the article of interest! I agree with your comment that photography is ‘bigger than ever’. Whether folks who are capturing their images with a phone will ever make the transition to a dedicated camera remains to be seen.

Tom

I often wonder how much of the camera market is outside of the Cipa numbers.

Maybe it is not a big portion in terms of cameras but the lens manufacturers that are not members of Cipa account for a growing number of lens sales I think. Samyang beeing the leader there. And it would be interesting to know how this affects the statistics when we try to understand where the market is really heading.

Hi Jon,

Yes, that may be an issue to some extent. Here is a link to a list of member companies: www.cipa.jp/guide…ist_e.html

I tend to look at this from a trend standpoint in terms of getting the big overview. If the member companies are seeing growth I think we can assume that the entire market is growing, if their numbers are declining it is doubtful that the non-member sales would be large enough to turn that around into a growth number…of course that is an assumption on my part.

Tom

Currently, CIPA stats don’t accurately capture the action camera market (GoPro is not a CIPA member). You could argue that action cams are really just miniature video cameras, but I think they’re partially relevant to the still camera market discussion. CIPA also would not be reliable for total medium format digital market numbers, if they published them. But that market is really tiny, in unit terms.

Otherwise, CIPA currently captures the overwhelming majority of the standalone camera market. There are a few European (e.g. Leica) and Chinese (e.g. Yi) manufacturers, but their sales are pretty tiny. That will change as Chinese camera companies develop and grow.

In the relatively recent past, CIPA figures for digital compacts materially undercounted the total market because Samsung (not a CIPA member) had a very large digital compact business — likely around 10-15 million units a year at its peak. In this article, the compact figures for 2007-2012 reflect that (which means that the compact market has contracted even more than CIPA figures imply). For ILC’s, Samsung’s business was never large enough to matter much.

CIPA also publishes some historical data going back to the 1950s (the organization’s name in those days was JCIA). The data from the 1950s, 60s, and 70s is not a particularly good proxy for global market scale in any camera category because there were several important European manufacturers in those days. By 1980, however, JCIA’s numbers for compact and 35mm cameras reflected nearly all of the global market. But that was never true for medium format cameras (because Hasselblad had a large medium format business right up until the end of film medium format cameras).

In my comments about historical numbers I should have added: from 1950-1990 or so there was a substantial camera market in the Eastern Bloc/Warsaw Pact — many tens of millions of cameras made and sold over that extended period, which was not counted by any Western market research organization or industry association that I know of.

HI Eamon,

Thanks for adding to the discussion!

Tom

Thanks for sharing such an article ! It is very interesting !

Can we say japanese people returned to DSLR and never really adopted mirrorless?

The mirrorless growth is probably, and mainly due to a sale increase in the hobbyist target in China, Indonesia etc…

The rest of the world and mostly professionnals, still trust in DSLR technology. In my shop, a majority of people still think that the bigger the camera, the better photos it can take : “For now my phone is good enough but if I’d buy a camera it will be this big one !” (Canon 1100D)

I think it will take quite a bit of time for mirrorless to kill the DSLR market. This year is marking a new transition though : we are beginning to see a really viable technology for the mirrorless sytem (Sony A9, A7r III). The real boom will happen when professionals will begin to switch for mirrorless technology and people will start to copy them…If CaNikon follows with a real competitive mirrorless system allowing professionnals to use they current lenses, then we’ll probably see a real gap between DSLR and mirrorless sales. Am I wrong to think like that?

Hi Jean-Francois,

Actually the opposite is true of the market in Japan, 45.5% of all interchangeable lens cameras are mirrorless. The chart in my article showing the importance of regional markets, indicates the percentage of mirrorless camera shipments of all global shipments of mirrorless cameras that the regional market represents. It does not show the market penetration of mirrorless cameras as a percentage of the total interchangeable lens camera market in that region.

For clarification, here are the percentages of the interchangeable lens camera market that are mirrorless in each region:

Japan = 45.5%

Asia = 42.7%

Europe = 29.7%

Americas = 21.6%

I have added this information to the article.

Tom

I think APS-C DSLR is the “sweet spot” in terms of bang for the buck.

Thanks for adding to the discussion John!

Tom

What does this give us? Is DSLR fading? CSC taking over the road?

Surprisingly, lens up by a notch.

Hi Alvin,

DSLRs have been dropping off a bit in 2017, but the share of mirrorless cameras of the entire interchangeable lens camera market has softened a bit the past 3 months or so. This is being driven by the strong mirrorless market in Asia. I think this tells us that DSLRs will be around for quite a while. The penetration of mirrorless cameras is very dependent on geographic region with the Americas having the slowest uptake of this technology.

Tom