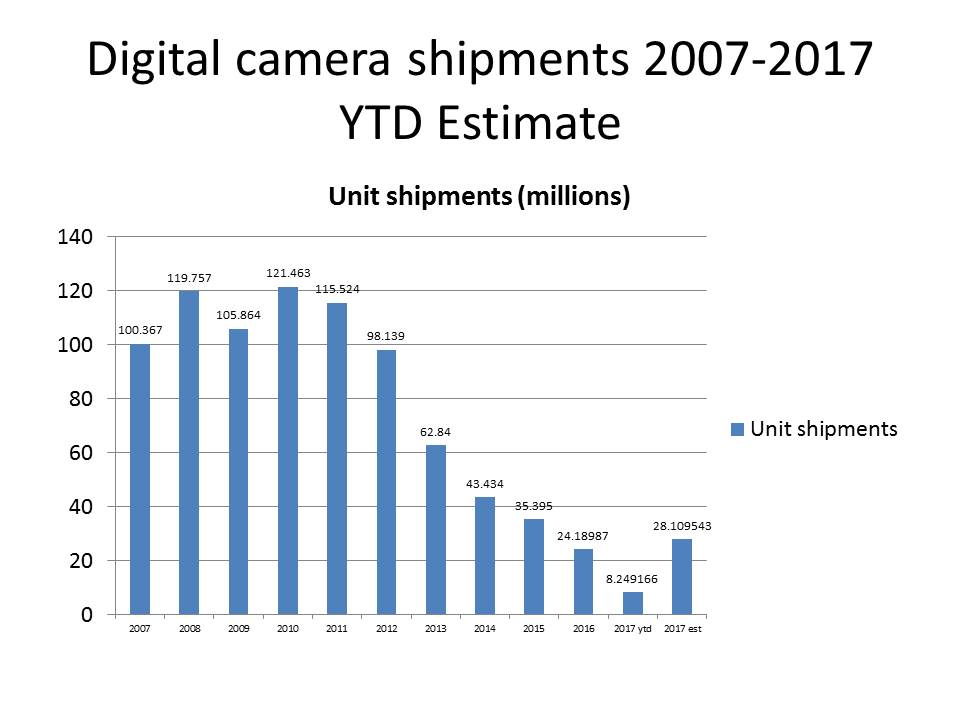

While I wait until quarterly data is available from CIPA to do full camera market updates on my photography blog, I thought Photography Life readers may like to have a quick look at how 2017 is shaping up for the digital camera market. The charts in this short article are based on April YTD 2017 CIPA statistics. I’ve included YTD actuals for 2017 as well as my market estimates for 2017. These estimates were calculated after examining some basic trends that the camera market has been demonstrating for the past decade.

Thus far in 2017 the overall trend for the digital camera market is reasonably positive. If things continue as they have for the past four months it would appear that the overall size of the digital camera market may show a modest volume increase when compared to 2016, but still below 2015 levels. Perhaps this is an early sign that the camera market is stabilizing.

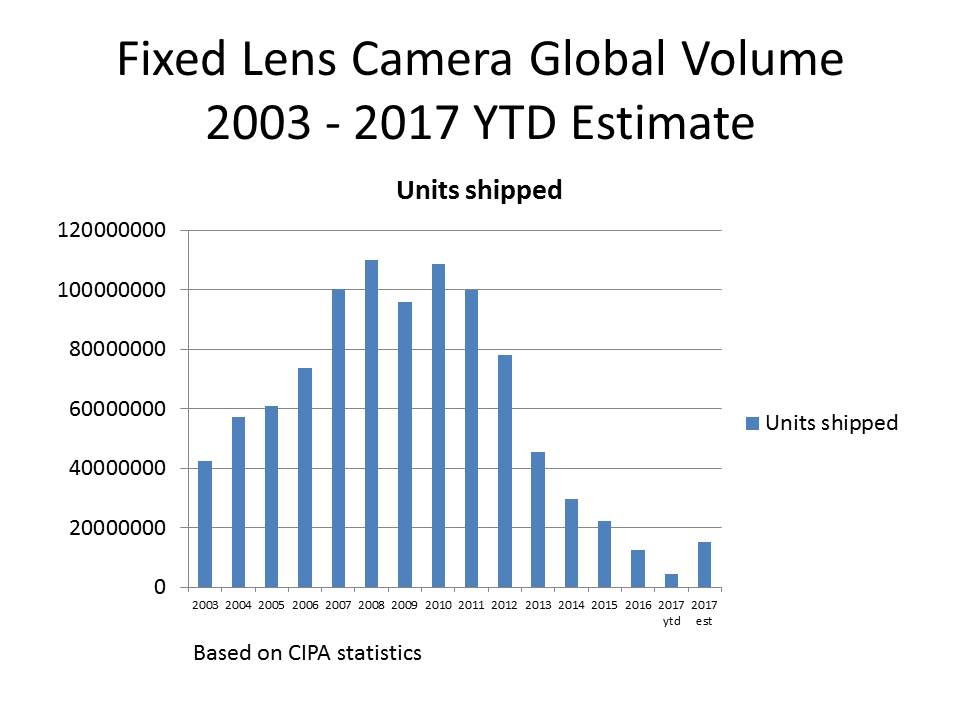

This fixed lens camera market, which has been in a precipitous decline for many years may actually show a modest increase in volume in 2017 if the current trend holds.

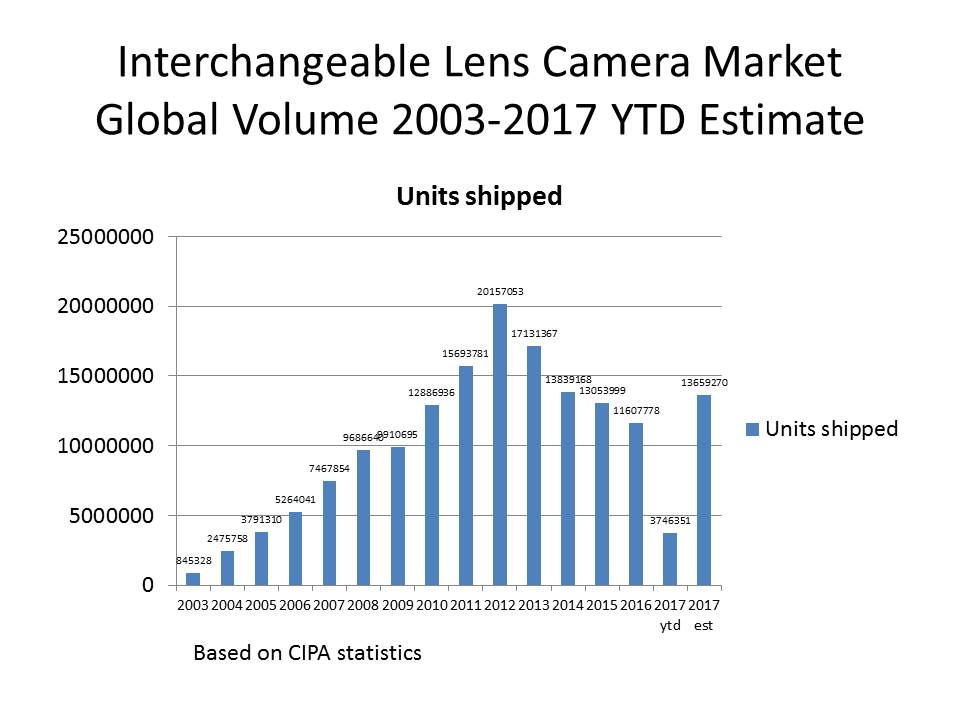

The current trend with the interchangeable lens camera market is even more positive with YTD 2017 indicating that this market may also show a volume increase, resulting in potentially higher shipment levels than experienced in both 2016 and 2015.

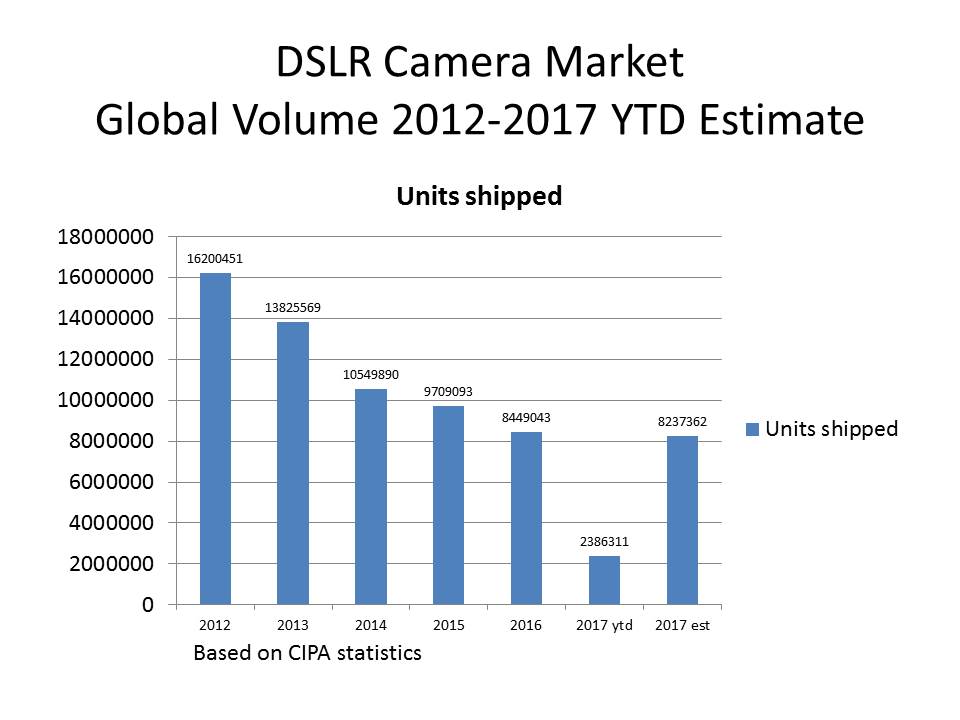

Shipments of DSLRs also appear to be stabilizing, but still may register slightly below the 2016 level, should the current trend continue.

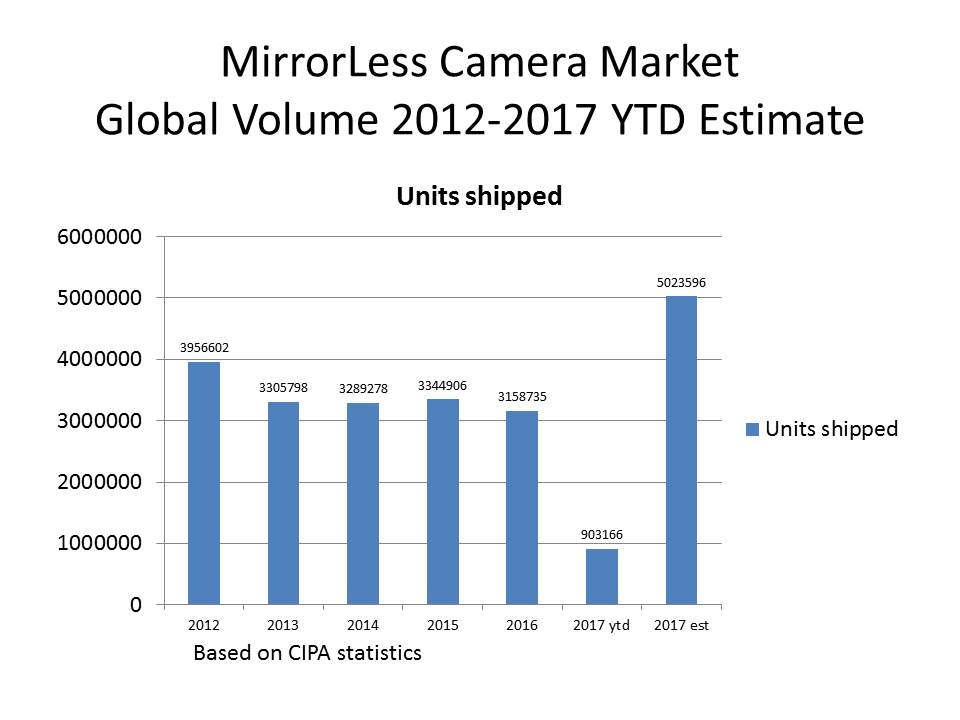

The brightest spot in the camera market in 2017 appears to be with mirrorless cameras, which are off to a strong start this year. If the trend continues the overall volume of mirrorless shipments could post significant gains. This could put some additional pressure on manufacturers like Nikon to potentially develop APS-C and/or full frame mirrorless cameras.

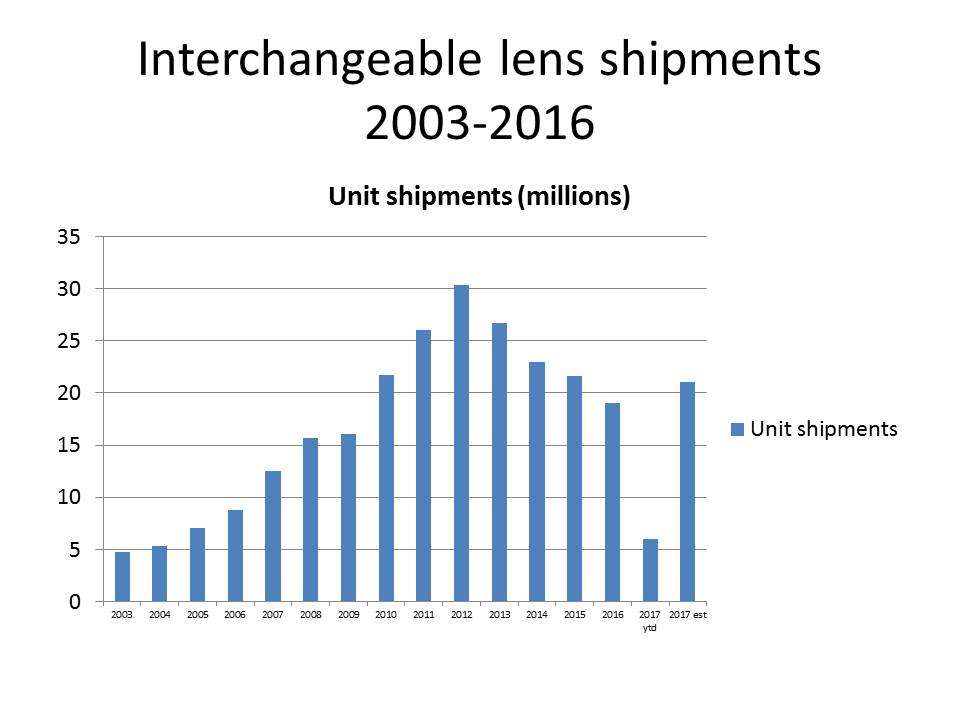

Shipments of interchangeable lenses are also showing potential volume growth for 2017, if the current trend continues. It is too early to predict any major resurgence of the camera market, but perhaps these YTD April 2017 statistics are at least pointing to a camera market that is stabilizing. If this is the case it will help the various manufacturers adjust their strategies accordingly. I’ll leave it to the readers at Photography Life to further interpret and debate what these recent CIPA statistics may mean for their favorite gear manufacturer.

Article and graphics are Copyright 2017 Thomas Stirr. All rights reserved. No use, adaptation or reproduction of any kind is allowed without written permission. Photography Life is the only approved user of this article. If you see it reproduced anywhere else it is an unauthorized and illegal use.

Thoroughly useful information – especially since I make a camera accessory of DSLRs and Mirrorless. It’s interesting to see my sales mirroring the year to year production

Thanks for the summary.

I’m glad the information was helpful Tom!

Tom

James question about whether estimates were used is valid. The article refers several times to variations of ‘if current trends continue’, which suggests, in the absence of additional info on the methodology used, that a straight-line extrapolation from the first 4 months was used to obtain the full year estimates.

In your answer to James you then say the estimate methodology is based on historical trends and refer to seasonality. I feel this should have been pointed out in the original article. This lack of clarity in the article justifies a question on whether the figures were based on estimates although I would have phrased it differently both as a question and in the wording.

Hi Pravin,

The first four months were not extrapolated. I created demand curves for each product category based on monthly shipment volumes over time, usually at least 10 years.

Tom

Well this is certainly encouraging news. Thanks for the work in putting it together.

I’ll be doing my next ‘full’ review when June CIPA data is available…likely at the end of July. We’ll see if the positive trends from the first part of the year continue.

Tom

Thomas- I always enjoy your post and your photos.

Illegitimi non carborundum.

Thanks for the supportive comment Michael!

Et non me tibi.

Tom

Numquam!

I really grow weary of the “sneaked in” political put-downs that are becoming w-a-y too common on this site. C’mon, guys, any one can call any politician a bad name. That takes no class, something that’s becoming a rare commodity in our society. I think of this as a site with class. You may be entitled to your political opinions, but please don’t try to “slip them in” and think the rest of us don’t know what you’re doing.

I just wanted to say that I enjoyed the article and the methodology behind it, Thomas and PL team. Don’t let ’em drag you down!

Thanks Greg…glad you enjoyed it! Don’t worry…the PL team is full of dedicated folks and nothing gets us down!

Tom

Geez,

James, they are estimates, but nonetheless they seem to be based on good reasoning. Still half of 2017 is yet pass (with most sales coming during christmas), and if you are estimating the yearly sales for 2017, I would like to know where the assumptions/estimations have a problem. I am not saying it is 100% correct, but as readers, we would like to know your take on the estimates. The author is more like saying the declining sales phenomenon appears to have bottomed out.

Seems like more than Trump teaching a thing or two about freedom of expression, you learned quite a lot from his rudeness, arrogance and non-civility…You need to learn a lot from human civilization…

For the record, I am in no way associated with PL, but just got annoyed by your ad hominem rant. Instead, we would all love to see your support for your argument and why you think there is a problem with article.

Hi Venu,

You are correct that the main point of the article was to indicate that, based on typical performance of the camera market as tracked over time, there is some initial evidence that the erosion in the camera market may have abated in 2017. As more months of data are forthcoming the data that may support this initial assessment will be more robust.

Even though the overall, global numbers looks somewhat encouraging at this point, there are some challenges in the camera market. One of the key volume drivers thus far in 2017 is the interchangeable lens camera market in Asia. This market now represents over 40% of global ILC volume. Another important issue is that the Asian market’s share of the global mirrorless camera market, is over 49% thus far in 2017. So, while the global camera market is showing some positive signs an economic disruption in Asia could cause downward pressure on the camera market.

Volume estimates are just that…estimates based on historical trends. I will be reassessing the accuracy of my estimates as the year progresses. There are a few anomalies in the historical data which I may need to treat differently depending on how accurate the estimates are at year end.

Tom

Attention grabbing headline as usual….Do you base your conclusion on estimates? Gosh!!

Attention grabbing headline as usual? Are you confusing our site with some other site?

Please be a bit more respectful to our team and if you have nothing to say, don’t. And if you do have something to say, feel free to share with the rest of our readers – we always welcome content at PL.

You sound like a wounded lion whenever faced with opposing views! Why is that? Old attitude die hard? Hasn’t Trump’s America taught you something about freedom of expression?

James, you are always welcome to express your opinion, but if you don’t do it nicely, we won’t welcome it here.

If you don’t learn manners, you are nothing but an internet troll…

And how in the world did Trump get involved?

Mr. Mansurov, unfortunately, you have a lot to learn from Western civilization..

James, I agree!

For one I agree Photography Life has always been true and stylish. Keep up the good work!

Good reply Nasim. I’m sorry James was such a jerk. No call for that behavior here or anywhere else.

Hi James,

The estimates that I prepare for my camera market articles are based on some basic analysis that I’ve done using published monthly CIPA statistics that cover a range of product categories over a multiple year period…typically at least 10 years. CIPA did not start breaking our DSLRs and mirror-less cameras until 2012 so that portion of my work is based on a shorter time frame. Many industries have demand curves that do not vary substantially from year to year in terms of monthly or seasonal importance. The demand curves for these types of industries, once calculated, can be used to estimate approximate future market volumes based on current partial year market performance.

Tom

Oh gee, it’s probably a good thing you didn’t include iPhone and Android phone sales charts. Too depressing. Or maybe it would suggest DSLR makers should find ways to compete with phones. Probably not realistic to make small, light full-frame bodies at reasonable prices that can use existing lenses. But education? Ads that show ordinary users doing extraordinary things with DSLRs? DSLRs as upgrades when phones can’t do the job?

Hi George,

iPhone and Android stats are not reported through CIPA which is an association of camera/lens manufacturers.

Tom